Trade Discovery

- For buyers and sellers who wish to conduct bilateral trading with different counterparties on the platform

- Sourcing for/selling of goods becomes more seamless

Kratos leverages advanced technology to attract new lending sources that address SME’s lack of access to funding, thus enabling trader growth and profitability

Minimizes operational risks through checks

Drives profitability and visibility

Easy to use platform with user-friendly interface

Applications for credit facilities or drawdowns are faster

Customizations and integrations with third party systems

Cloud-based results in zero downtime, leading to higher efficiency

Buyers/Manufacturers collaborate with lenders to provide short-term financing for their suppliers & vendors

Account receivables are purchased by lenders to provide short-term financing to suppliers

Loans are granted by lenders to finance suppliers based on invoices generated on their buyers

Financing Steps:

Kratos gives lenders access to a market that they want to lend in, but often cannot otherwise reach in a cost-efficient manner

Minimizes operational risks through KYC/AML checks, company credit report checks, and checks for bill of lading & other key documents

Instant access to other commodities and new borrowers for a greater range of investments that fit the lenders’ risk appetite

Supports strategic decisions with customizable data visualization via modular dashboard that focuses on financing metrics

Kratos addresses traders’ main problem by enabling their access to tailored financing options quickly through a transparent system that facilitates their growth

Proposes prospective lenders to buyers; increases visibility to potential financiers; timely availability of funding for trading

Allows faster & more efficient trade transactions, thus reducing overhead costs

Supports strategic decisions with customizable data visualization via modular dashboard that focuses on trading metrics

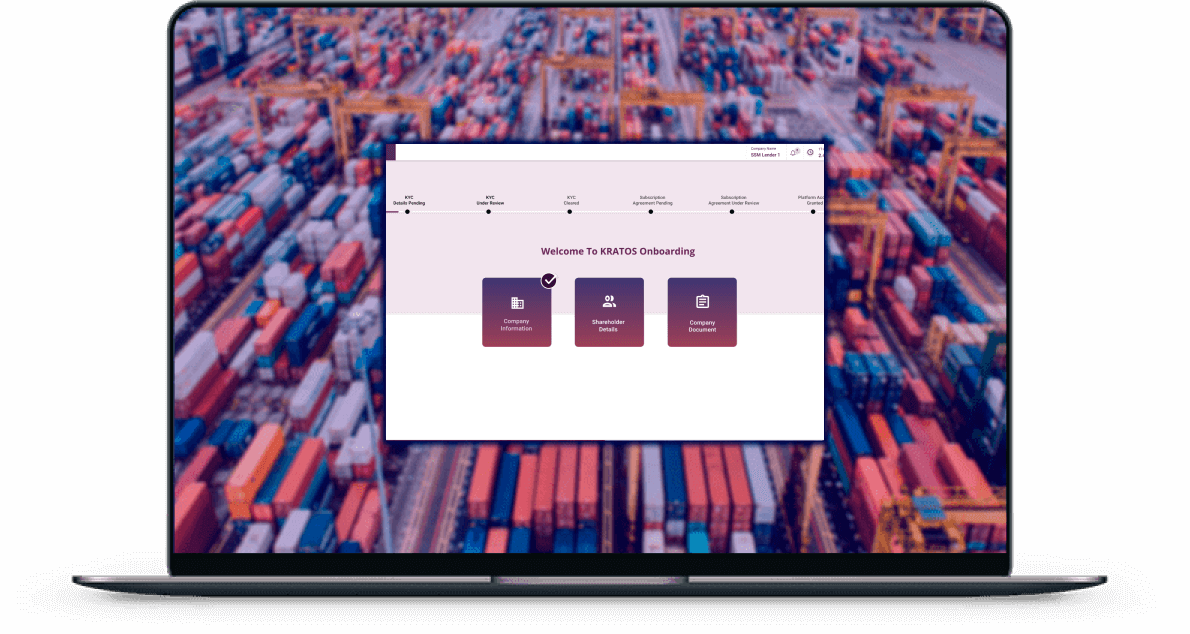

Industry-grade Know-Your-Customer (KYC)/Anti-Money Laundering (AML) background checks to verify client details and enhance security and compliance

Trade documents are digitized and stored in blockchain to ensure transparency and efficiency and reduce the chances of document alteration

Customizable data visualization via modular dashboard to support strategic decision-making and provide actionable insights

Role-based and/or user-based permissions are assigned to individuals to specify what actions can be performed

System notifications through the platform and email are in place to update users on their transactions

Communicate directly with counterparts and lenders in your network and access chat history for easy reference

The trade finance industry is dominated by multinational corporations and banks that prefer to finance large transactions, while underserving small and medium-sized enterprises (SMEs). Banks have pulled back partially from financing SMEs because of Basel III’s increase in capital requirements and the increased scrutiny on the AML and KYC processes. In the face of these trends, banks have quite rationally focused on their largest and best multinational customers.

Several European and American funds find the market attractive but trying to address in scale is challenging. It is difficult to source, conduct due diligence and execute a loan in Asia and track it appropriately while sitting in London or San Francisco. This is especially true since funds, unlike banks, typically do not employ a large back office team to do KYC/AML background checks and detailed transactional document checks at every level. Fraud is a constant possibility given the historic lack of transparency.

This led to the creation of the Kratos platform to improve reliability in global trade and trade finance using blockchain technology.

You may click on the ‘Request Demo’ button at the top of the page or email us at contact@p4.iconceptdigital.com

We partner with alternative lenders and private equity managers who have longstanding relationships with Triterras.

Yes, your company name and corporate email address are required during sign-up.

Kratos is a web application developed on Ethereum decentralised technology. However, in mid 2021, we transitioned our Kratos platform to Amazon Web Services (AWS) managed Hyperledger private blockchain. It enhances Kratos’ security by placing it behind a robust ‘wall’ of security tools and protections afforded by the best-in-class AWS infrastructure, which specifically mitigates any potential security issue.

Risk Mitigation: Data is stored in a distributed and replicated chain of servers which prevents any data modification/tampering

Efficiency: Paperless documents such as e-contract, e-invoice, etc make trade transactions faster and efficient, thus reducing overhead costs

Traceability: Transactions are timestamped and chronologically stored in blocks, ensuring complete history for each transaction

Secure: Secure and trusted trade transaction environment since blocks are cryptographically sealed in a chain

24/7 System Availability: No downtime & 24/7 availability given the decentralized network architecture that prevents overall system failure